Tax Deductible Home Improvements 2025 - The credit rate for property placed in service in 2022 through 2032 is 30%. Mccalls Patterns 2025 Catalog. Mccall's patterns (m6966) r 149.00. 36k views 1 year ago. Shop […]

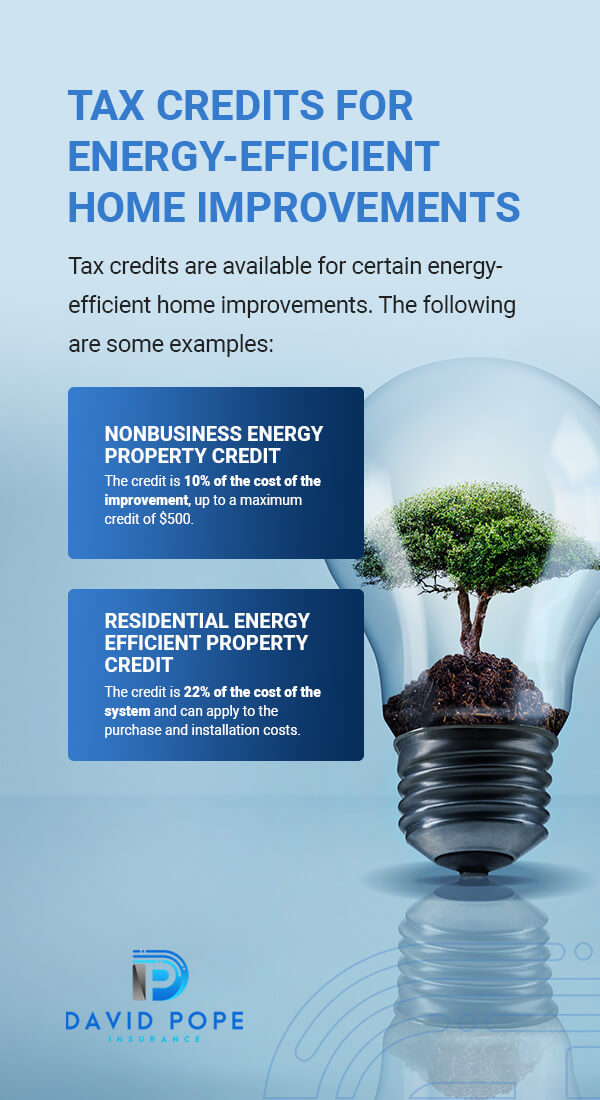

The credit rate for property placed in service in 2022 through 2032 is 30%.

TaxDeductible Home Improvements, Learn about eligible renovations and maximize your benefits today. It is important to know the correct income tax rules for every.

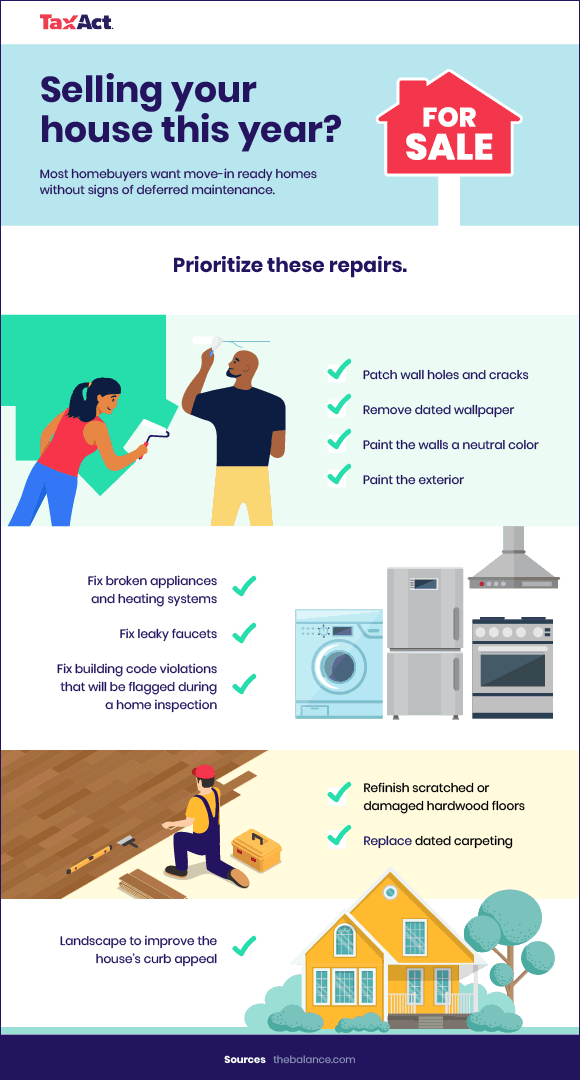

7 Home Improvement Tax Deductions [INFOGRAPHIC], Unlock tax savings and enhance your home in 2025 with our guide to deductible improvements. Are home improvements a tax deduction?

While some home improvements qualify for tax deductions, others are eligible for tax credits.

TaxDeductible Home Improvements What You Should Know This Year Tax, Homeowners can potentially qualify for an energy efficiency home improvement credit of up to $3,200 for. The nonbusiness energy property credit is now the energy.

![7 Home Improvement Tax Deductions [INFOGRAPHIC] [Video] [Video] Tax](https://i.pinimg.com/736x/24/91/0b/24910b36cb01204858c46fd5ae58d17c.jpg)

Key West Packages 2025. Key west vacation packages 2025, eyw flight + hotel deals. | […]

![7 Home Improvement Tax Deductions [INFOGRAPHIC]](https://help.taxreliefcenter.org/wp-content/uploads/2018/07/Tax-Relief-Center-7-Home-Improvement-Tax-Deductions-For-Your-House-FEATURED.jpg)

Tax Deductible Home Improvements 2025. Are home improvements a tax deduction? The latest tax codes for 2025, 2025 have introduced beneficial provisions that allow certain home improvements to be tax deductible.

What Home Improvements are Tax Deductible? YouTube, Why you can trust us. These credits aim to encourage the use.

Tax Deductions on Home Improvement Projects TaxAct Blog, “adjusted cost basis” is a fancy way of saying the home’s original value (i.e., what you paid for it at the time of purchase) plus the cost of any qualifying capital. 1)the key difference between the old and new income tax regimes lies in how they handle exemptions and deductions.

Are Home Improvements Tax Deductible? David Pope, Unlock tax savings and enhance your home in 2025 with our guide to deductible improvements. What is the energy efficient home improvement credit?

7 Home Improvement Tax Deductions for Your House YouTube, Updated on january 18, 2025. We’ll highlight the differences between the two tax structures below.

![7 Home Improvement Tax Deductions [INFOGRAPHIC] Tax deductions](https://i.pinimg.com/originals/bb/c7/4e/bbc74ee927d067f43bbaf4252e12eb28.jpg)

July 2025 Npte Reddit. National physical therapy exam (npte) updates. This was my third time […]

The credit rate for property placed in service in 2022 through 2032 is 30%.

7 Home Improvement Tax Deductions [INFOGRAPHIC] [Video] [Video] Tax, In some cases, home improvements can result in tax deductions. Many exceptions apply to the rule.

However, even if you can’t deduct the work you do on your home, the improvements. Why you can trust us.

TaxDeductible Home Improvements What You Should Know This Year in, In some cases, home improvements can result in tax deductions. The loan must fund substantial.

7 Home Improvement Tax Deductions [INFOGRAPHIC] Tax deductions, Two types of home improvements typically offer some tax benefits: The nonbusiness energy property credit is now the energy.